trading-btc.site

Gainers & Losers

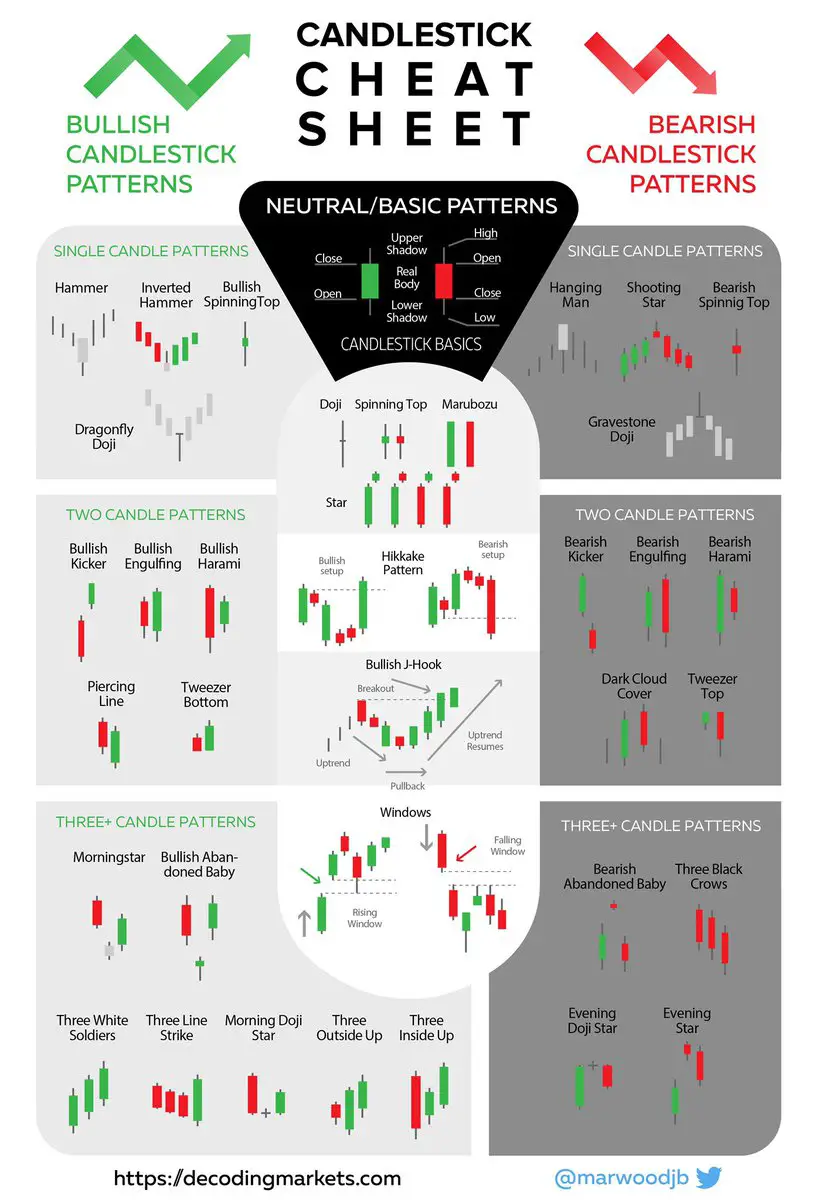

Stock Market Candle Patterns

A candlestick pattern is a candlestick presentation that shows the interaction between buyers and sellers in the stock market. The nature of the candlestick . This section contains descriptions of the predefined candlestick patterns. These candlestick patterns are split into three groups: Bearish and Bullish, Bearish. Candlestick patterns are useful price formations that may provide guidance about the future direction that a price will move. A candlestick pattern refers to the shape of a single candlestick in trading. So if you're trading the one-hour time frame, any pattern that forms is the result. Candlestick patterns are used to predict the future direction of price movement. Discover 16 of the most common candlestick patterns and how you can use. New Latest Releases New · Engulfing, bearish · Engulfing, bullish · Evening doji star · Evening star · Event patterns · Falling 3 methods · Falling window · Gapping. This is a single candlestick pattern in which the opening and closing prices are the same - ones within a very small range will also qualify. The Doji pattern is formed when a market's opening and closing prices in a period are equal – or very close to equal. So whatever happened within the. This is a single candlestick pattern in which the opening and closing prices are the same - ones within a very small range will also qualify. A candlestick pattern is a candlestick presentation that shows the interaction between buyers and sellers in the stock market. The nature of the candlestick . This section contains descriptions of the predefined candlestick patterns. These candlestick patterns are split into three groups: Bearish and Bullish, Bearish. Candlestick patterns are useful price formations that may provide guidance about the future direction that a price will move. A candlestick pattern refers to the shape of a single candlestick in trading. So if you're trading the one-hour time frame, any pattern that forms is the result. Candlestick patterns are used to predict the future direction of price movement. Discover 16 of the most common candlestick patterns and how you can use. New Latest Releases New · Engulfing, bearish · Engulfing, bullish · Evening doji star · Evening star · Event patterns · Falling 3 methods · Falling window · Gapping. This is a single candlestick pattern in which the opening and closing prices are the same - ones within a very small range will also qualify. The Doji pattern is formed when a market's opening and closing prices in a period are equal – or very close to equal. So whatever happened within the. This is a single candlestick pattern in which the opening and closing prices are the same - ones within a very small range will also qualify.

These candlestick charts include the doji, the morning star, the hanging man and three black crows. Ryan talks through reading candlestick charts like a. Some of the more popular ones include the hammer candlestick, bullish engulfing pattern, spinning top, piercing line, and doji star. What are some popular. 70 Different Types of Candlestick Patterns (Trading Rules + Backtests) · 1. Hammer · 2. Inverted Hammer · 3. Bullish Engulfing Pattern · 4. Piercing Pattern · 5. These 14 most reliable candlestick patterns provide to traders more than 85% of trade opportunities emanating from candlesticks trading. Learn about all the trading candlestick patterns that exist: bullish, bearish, reversal, continuation and indecision with examples and explanation. Candlestick patterns are useful price formations that may provide guidance about the future direction that a price will move. Top 5 candlestick patterns for trading · Doji · Dragonfly and gravestone dojis · Hammer · Hanging man · Belt hold. Candlestick patterns are a technical analysis tool that captures that emotion and sentiment into a quick and easily understood picture. Candlestick patterns can. For example, a candlestick that appears at a swing high or low with short wicks and a very small real body is known as a Doji and represents indecision in the. New Latest Releases New · Engulfing, bearish · Engulfing, bullish · Evening doji star · Evening star · Event patterns · Falling 3 methods · Falling window · Gapping. In this course I'll walk you through step-by-step from A to Z on how to trade candlestick patterns even if you have no trading experience. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. Candlestick patterns are a powerful tool used by stock & crypto traders to predict the direction of the stock market, candlestick patterns can show the. Candlestick patterns typically represent one whole day of price movement, so there will be approximately 20 trading days with 20 candlestick patterns within a. Candlestick pattern strategy aims to evaluate how asset prices have behaved in the past and identify repeating shapes and forms of candlesticks. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to. Doji often appears when the market is in the overbought/oversold zones, being a reversal candlestick pattern. There are several types of doji candlestick. Bullish Reversal Candlestick Patterns ; Bullish Doji Star · Bullish Engulfing · Bullish Hammer ; Bullish Harami Cross · Bullish Homing Pigeon · Bullish Inverted. Candlestick charts, despite their historical origins, are straightforward and clear. They contain the same data as a standard bar chart but highlight the. For example, a candlestick that appears at a swing high or low with short wicks and a very small real body is known as a Doji and represents indecision in the.

House Loan Cost

Our mortgage calculator lets you make informed decisions about your home financing. Start exploring your options today and take the first step toward your. $1,, $5, $ Home price. $. Down payment. $. %. Loan program. year fixed, year fixed. Interest rate. %. Include PMI. Include taxes/insurance. Property. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. What's included in a mortgage payment? Your mortgage payment consists of four costs, which loan officers refer to as 'PITI.' These four parts are principal. The importance of home loan calculator tools Before you buy, you can view your estimated home price and monthly payment based on your location, household. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for. Free online mortgage calculator specifically customized for use in Canada including amortization tables and the respective graphs. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Calculate what your mortgage payment could be. Find out how changing your payment frequency and making prepayments can save you money. Our mortgage calculator lets you make informed decisions about your home financing. Start exploring your options today and take the first step toward your. $1,, $5, $ Home price. $. Down payment. $. %. Loan program. year fixed, year fixed. Interest rate. %. Include PMI. Include taxes/insurance. Property. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. What's included in a mortgage payment? Your mortgage payment consists of four costs, which loan officers refer to as 'PITI.' These four parts are principal. The importance of home loan calculator tools Before you buy, you can view your estimated home price and monthly payment based on your location, household. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for. Free online mortgage calculator specifically customized for use in Canada including amortization tables and the respective graphs. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Calculate what your mortgage payment could be. Find out how changing your payment frequency and making prepayments can save you money.

P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. Calculate your mortgage · Home Purchase Price · Down Payment % · Interest Rate. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. Default interest rate displayed is illustrative only. Interest rates, total cost of mortgage, and monthly mortgage payment are estimates based on information. Interest is the extra amount charged by the lender in exchange for the loan. Other costs you need to factor in each month toward your total monthly payment. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Our mortgage calculator can help you determine an affordable home price for you, taking into account your other debts (such as auto or student loans), monthly. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Calculate your mortgage payments based on how much you borrow, your interest rate, mortgage term and payment schedule. To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. But if you don't have 20%, you can put. The interest rate on a mortgage has a direct impact on the size of a mortgage payment: Higher interest rates mean higher mortgage payments. Higher interest. Your monthly payment may include additional costs, including HOA fees, condo fees and utilities, which are not included. Loan terms and mortgage interest rates. Mortgage Payment This is the amount that you pay each month that goes toward paying down the principal of the loan and the cost of borrowing (interest). $2, Use this calculator to figure out what you will pay each month for your mortgage — the amount of money you intend to borrow to buy your new home. The total cost of home ownership is more than just mortgage payments. Additional monthly costs include homeowner's insurance, property taxes, Home Owners. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan.

Compare Bank Accounts

Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Wondering which kind of checking account is right for you? View our Renasant Bank Checking Account Comparison here for more details. We've compared checking accounts at 66 nationally available banks and credit unions to find some of the best options available. How checking and savings accounts differ. The primary benefit of a checking account is to provide you with access to your money for everyday needs. Savings. Compare Bank of Ireland's range of current accounts. Choose the one that suits your needs the most. Apply for the current account of your choice today. Academy Bank offers multiple checking account options to fit your finances. View our selection of checking accounts and open an account online today. Compare local banks and credit unions for free. Personalized Results. We track over 50 fees and features to match you to the best accounts. Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. See NerdWallet's picks for the Best Checking Accounts of September These accounts have low fees and consumer-friendly features. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Wondering which kind of checking account is right for you? View our Renasant Bank Checking Account Comparison here for more details. We've compared checking accounts at 66 nationally available banks and credit unions to find some of the best options available. How checking and savings accounts differ. The primary benefit of a checking account is to provide you with access to your money for everyday needs. Savings. Compare Bank of Ireland's range of current accounts. Choose the one that suits your needs the most. Apply for the current account of your choice today. Academy Bank offers multiple checking account options to fit your finances. View our selection of checking accounts and open an account online today. Compare local banks and credit unions for free. Personalized Results. We track over 50 fees and features to match you to the best accounts. Explore checking account options designed to fit your changing needs. Open a Bank of America Advantage Banking account online today. See NerdWallet's picks for the Best Checking Accounts of September These accounts have low fees and consumer-friendly features.

Open a checking account online at Citizens. Enjoy secure banking, mobile check deposit, overdraft solutions and more. Compare checking accounts and apply. View all checking accounts. Browse All Still not sure? Answer a few quick questions to help you find the right account. Compare checking accounts. Comparing products 1 & 2. 1 2 3. For you if Fees and pricing. Overdraft coverage and protection. Benefits and features. Chequing accounts for daily life. From pay-as-you-go to unlimited transactions, it all adds up to what works for you. Compare checking accounts. Find the best account for you. Clear Access Banking. Everyday Checking. Monthly service fee $5. Avoid the $5 fee each fee period. Whether you're looking to earn a high interest rate, cash back on your spending, or add-on benefits we can help you find the best current account for you. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Compare savings accounts, high yield savings accounts, compound interest savings, savings accounts rates, savings accounts reviews. Compare features & benefits and select a Citi Relationship Tier that is right for you. Open your Citi checking & savings accounts today. A current account is a type of everyday bank account that's designed to help you manage your money. It gives you instant access to your funds. Compare checking accounts with WalletHub's free tool and read ratings and reviews from other consumers. Find the best account for you and apply online. Choose the type of account you're looking for and we'll show you a range of options. You can compare interest rates, overdraft limits, account benefits and more. Compare more than , deposit rates from over 11, banks and credit unions, for free. SAVINGS ACCOUNTS. Top 1% Avg. % APY. Nat'l. No fees for incoming wires, stop payments, electronic deposits & more. Compare business checking accounts. Fundamentals™ Banking. Relationship Banking. A checking account is an accessible, convenient, reasonably priced and safe place to keep money you use regularly. Don't expect to earn much extra cash from a. When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Huntington Premier Savings · Huntington Relationship Savings · Huntington Relationship Money Market Account · Compare Savings Accounts · Interest · FREE Checking. The main difference between checking and savings accounts is that checking accounts are primarily for accessing your money for daily use while savings accounts. Martin Lewis reveals how to compare and switch to the best current accounts that can save you £s a year. Minimum Balance to Avoid Service Charges: $5, average daily balance in this account OR $15, in combined deposit balances (checking, savings, money market.

Best Tax Free Investments For Retirement

We love both RRSPs and TFSAs. They're great retirement-saving The gains you make from any investments and savings in the account are tax-free, i.e. all yours. Tax-advantaged accounts such as (k)s and IRAs are an investor's best friend. Here's why: First, any earnings in these accounts can grow tax-free (although. Tax-Efficient Investments ; Qualified dividend-paying stocks and mutual funds, Taxable bond funds, inflation protected bonds, zero-coupon bonds, and high-yield. Contributions to a traditional IRA may be tax deductible, and the potential investment tax deferred until you make withdrawals during retirement. If. Because you've already met your tax obligations for that income, anything you set aside in the account will grow tax-free and won't be taxed again when you. In retirement, your income may come from annuities, pensions, qualified retirement plans such as (k)s and IRAs, taxable savings and Social Security. As you. This can be done since Roth accounts aren't subject to RMDs, and withdrawals are entirely tax-free after age 59½ assuming you've held the account for at least. TFSAs and RRSPs both offer tax advantages that can help you achieve your saving and investing goals. So, which is right for you? Consider investing in a Roth IRA and ladder bonds and annuities. Lower your taxes in retirement. It's natural to put off retirement planning—there are families. We love both RRSPs and TFSAs. They're great retirement-saving The gains you make from any investments and savings in the account are tax-free, i.e. all yours. Tax-advantaged accounts such as (k)s and IRAs are an investor's best friend. Here's why: First, any earnings in these accounts can grow tax-free (although. Tax-Efficient Investments ; Qualified dividend-paying stocks and mutual funds, Taxable bond funds, inflation protected bonds, zero-coupon bonds, and high-yield. Contributions to a traditional IRA may be tax deductible, and the potential investment tax deferred until you make withdrawals during retirement. If. Because you've already met your tax obligations for that income, anything you set aside in the account will grow tax-free and won't be taxed again when you. In retirement, your income may come from annuities, pensions, qualified retirement plans such as (k)s and IRAs, taxable savings and Social Security. As you. This can be done since Roth accounts aren't subject to RMDs, and withdrawals are entirely tax-free after age 59½ assuming you've held the account for at least. TFSAs and RRSPs both offer tax advantages that can help you achieve your saving and investing goals. So, which is right for you? Consider investing in a Roth IRA and ladder bonds and annuities. Lower your taxes in retirement. It's natural to put off retirement planning—there are families.

T. Rowe Price Insights: Perspectives on the markets, retirement, and personal finance to help inform your investing journey. Lower maximum tax rates on capital gains and dividends would make the investment return for the taxable investment more favorable, thereby reducing the. Just as it sounds, a tax-deferred account means you may not pay income taxes during the year on earnings and growth (or on contributions made during the year). Individual Retirement Accounts (IRAs) – Traditional and Roth. Traditional IRAs may allow you to contribute on a pre-tax basis, depending on your income level. Roth IRA or Roth (k) – Roth IRAs and Roth (k)s have tax-free qualified withdrawals at retirement since taxes are paid on contributions. · Municipal Bonds. Taxable bonds and bond funds · Multi-asset funds · Actively managed equity funds · High-dividend-paying equities and dividend-focused funds · REITs and REIT funds. Make saving for retirement a priority. Devise a plan, stick to it, and set Put your savings in different types of investments. By diversifying this. Here's why 60% of Canadians invest in a TFSA1: · Pay no taxes on any investment earnings · Contribute even if you're retired or not employed · Contribute for as. Open an IRA If you're already saving in an employer plan up to the match—or if your employer doesn't offer a retirement plan—your best course of action may be. What they are: Taxable accounts include bank savings accounts and personal investment accounts. Your contributions to these accounts are made after taxes, so. Two of the most commonly-used tax-exempt accounts in the U.S. are the Roth IRA and Roth (k). Contribution limits for Roth IRAs and Roth (k)s are the same. Registered Retirement Savings Plans (RRSPs) are a cornerstone of many Canadians' strategy to save for life after work. According to figures released by. Start with the best options, such as your employer's (k) or (b) retirement plans, or an IRA/Roth IRA. You can also invest money tax-free through an HSA. All of those benefits are tax free! Using tax-free income streams first could limit the need for retirees to tap into taxable retirement income in order to. Interest paid on investments in taxable accounts is taxed at your regular rate. But other income—from both your capital gains and qualifying dividends—is taxed. But watch out: sums withdrawn from an RRSP are taxable. This makes RRSPs a great retirement savings vehicle because it is less tempting to withdraw amounts and. For the tax year, single filers with taxable income up to $47,,, the long-term capital gains rate is 0%. If taxable income is between $47, and. Tax-advantaged accounts such as (k)s and IRAs are an investor's best friend. Here's why: First, any earnings in these accounts can grow tax-free (although. Tax implication: All earnings and withdrawals from a TFSA are tax-free. TFSAs generally work best when tax rates at withdrawal are higher than when. Your earnings will accumulate tax deferred and generally won't be treated as taxable income until you start taking payments. And you may be able to structure an.

Is Christian Mingle Free To Message

Match is not free! You pay for that one! So it is hoped they can screen scammers out a bit better. A little pricey here! Christian Mingle! One of the biggest surprises of the Christian Mingle free trial offer is that you actually get some abilities to send messages. Often, dating apps won't let you. Yes, there is a Christian Mingle app! Our free app makes it incredibly easy and convenient to stay connected to your matches from your phone or tablet. Is ChristianMingle free? You can sign up for an account, create your profile, and search for matches for free. For other features, such as messaging. Join the largest Christian dating site. Sign up for free and connect with other Christian singles looking for love based on faith. The best $35 I've ever spent is on a month membership. If I hadn't done that, I wouldn't have been able to message or respond to messages, and I wouldn't. What is the difference between a free membership and a Premium subscription? How do I block a member from contacting me? Setting up your profile is free, but you can't do much on the dating site without a paid membership. Exchanging messages requires a subscription. CatholicMatch. Very nice messages, but I'm realizing it does not sound like a real person would talk. Tons of emojis and that he is so happy we're messaging but does not ask. Match is not free! You pay for that one! So it is hoped they can screen scammers out a bit better. A little pricey here! Christian Mingle! One of the biggest surprises of the Christian Mingle free trial offer is that you actually get some abilities to send messages. Often, dating apps won't let you. Yes, there is a Christian Mingle app! Our free app makes it incredibly easy and convenient to stay connected to your matches from your phone or tablet. Is ChristianMingle free? You can sign up for an account, create your profile, and search for matches for free. For other features, such as messaging. Join the largest Christian dating site. Sign up for free and connect with other Christian singles looking for love based on faith. The best $35 I've ever spent is on a month membership. If I hadn't done that, I wouldn't have been able to message or respond to messages, and I wouldn't. What is the difference between a free membership and a Premium subscription? How do I block a member from contacting me? Setting up your profile is free, but you can't do much on the dating site without a paid membership. Exchanging messages requires a subscription. CatholicMatch. Very nice messages, but I'm realizing it does not sound like a real person would talk. Tons of emojis and that he is so happy we're messaging but does not ask.

You can send and receive messages for free while your free trial lasts. If you're serious about finding your perfect match, we're here for you. It's free. Owned by the parent company for trading-btc.site, OKCupid is a free online dating site. Technically, it's not completely free, but we'll get to that later. It's been. free trial version of Christian Mingle. I was given limited access to view profiles, and I couldn't always respond to messages that I received. One day, a. Online in the largest christian singles. Communicate. Read reviews by christian east leroy singles, s of free christian dating app where you need to. ChristianMingle Prices and Costs Creating an account at Christian Mingle is free but in order for you to gain full access to the site, you need to have a paid. The Christian Mingle dating app is % free to download, and is available for both iOS and Android devices. However, you will need a paid subscription to. Christian Mingle does have a free option, but it is significantly limited. Even when people didn't lie or mislead in their profiles, which they often did, I got. Join the largest Christian dating site. Sign up for free and connect with other Christian singles looking for love based on faith Christian Mingle. Privacy. It's free to start an account, free to check on recommendations based on your preferences and if you match with someone, you're able to chat for free! It's. The free version is limited because you must be a paid member to respond to messages. It's unsuitable for singles seeking a less serious and casual dating. Best of all, there's a free membership option. Another fantastic choice is ChristianCafe. This site has more of a close-knit community vibe. Christian Mingle – Top Popular Christian Dating Site. Pros. Quick, easy signup process; Clean and clutter-free layout; Good value for money; Large, active paid. You have to pay in order to message. They should turn this into Bumble with features unlocked behind a paid wall, not messaging locked behind a paid-wall. It's. Christian Mingle does have a free option, but it is significantly limited. Even when people didn't lie or mislead in their profiles, which they often did, I got. It's free to start an account, free to check on recommendations based on your preferences and if you match with someone, you're able to chat for free! It's. Christian Mingle Cost. While creating a profile and browsing for matches is totally free, exchanging messages with women requires a subscription. The best $35 I've ever spent is on a month membership. If I hadn't done that, I wouldn't have been able to message or respond to messages, and I wouldn't. A wink is a risk free way of gauging interest, it's permissible to ignore a wink but rude to ignore a message. Don't Miss To Read: 1. You can not message others with the free account unless a premium member messages first. By: Michele Baird. Who owns ChristianMingle? Is ChristianMingle free? You can sign up for an account, create your profile, and search for matches for free. For other features, such as messaging.

Growth Fund Of America C Share

The main objective of the fund is to provide long-term growth of capital through a diversified portfolio of common stocks. PROFILE · Inception Date · Category · NAV · Index · Issuer Name · Dividends per share (TTM) · Dividend Yield · Next Dividend Pay Date. The Fund invests primarily in common stocks in companies that appear to offer superior opportunities for growth of capital. The Fund seeks to invest in. %. Broadcom Inc, %. Eli Lilly and Co, %. Alphabet Inc Class C, Fund Size. Share Class Size, m USD. Performance is for the period. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. If an expense waiver was in place during the period. Vanguard U.S. Growth Fund Investor Shares (VWUSX) - Find objective, share price, performance, expense ratio, holding, and risk details. Analyze the Fund American Funds The Growth Fund of America ® Class C having Symbol GFACX for type mutual-funds and perform research on other mutual funds. Find the latest performance data chart, historical data and news for The Growth Fund of America Class C Shares (GFACX) at trading-btc.site Get the latest American Funds The Growth Fund of America® Class C (GFACX) real-time quote, historical performance, charts, and other financial information. The main objective of the fund is to provide long-term growth of capital through a diversified portfolio of common stocks. PROFILE · Inception Date · Category · NAV · Index · Issuer Name · Dividends per share (TTM) · Dividend Yield · Next Dividend Pay Date. The Fund invests primarily in common stocks in companies that appear to offer superior opportunities for growth of capital. The Fund seeks to invest in. %. Broadcom Inc, %. Eli Lilly and Co, %. Alphabet Inc Class C, Fund Size. Share Class Size, m USD. Performance is for the period. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. If an expense waiver was in place during the period. Vanguard U.S. Growth Fund Investor Shares (VWUSX) - Find objective, share price, performance, expense ratio, holding, and risk details. Analyze the Fund American Funds The Growth Fund of America ® Class C having Symbol GFACX for type mutual-funds and perform research on other mutual funds. Find the latest performance data chart, historical data and news for The Growth Fund of America Class C Shares (GFACX) at trading-btc.site Get the latest American Funds The Growth Fund of America® Class C (GFACX) real-time quote, historical performance, charts, and other financial information.

American Funds The Growth Fund of America® Class C. $ CGFCX Single charge paid by the investor when they purchase shares of the fund. View the latest American Funds Growth Fund of America;A (AGTHX) stock price C-Suite · Deals · Earnings · Energy & Oil · Entrepreneurship · Telecom · Retail. The fund has returned % over the past year (grade of C), % over the $, Mil. Share Class Type: A. Portfolio Turnover: 31%. Management Team. The funds' gross expense ratios as of the prospectus dated 3/1/ are as follows: A Shares %, C Shares % and I Shares %. Class I shares are. American Funds Growth Fund of Amer C Overview American Funds / Large Growth ; YTD Return · % · % ; 1-Year Return · % · % ; 3-Year Return · %. The fund seeks long-term capital growth by investing predominantly in the equity securities of companies located anywhere in the world, including developing. Focuses on achieving a long-term risk/return profile similar to an investment in 90% equity/10% fixed income portfolio; Managed by experienced Multi-Asset. American Funds Growth Portfolio C GWPCX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. Get the latest American Funds The Growth Fund of America Class C (GFACX) stock price quote with financials, statistics, dividends, charts and more. ALPHABET INC CL C %; ALPHABET INC CL A %; NETFLIX INC Domestic Stock Funds Global Stock Funds Specialized Funds Enhanced Index Funds Load Funds. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. Eli Lilly & Co. %. 8. GOOG · Alphabet Inc. Cl C. %. 9. GOOGL · Alphabet Tesla Stock's Surge Is Lifting These 6 Funds. Plus the Huge Ones That Are. C- (Hold). How We Rank The Best Funds. Trailing Total Returns Monthly. 1-Month Invest in stocks, fractional shares, and crypto all in one place. Open An. Vanguard U.S. Growth Fund Investor Shares (VWUSX) - Find objective, share price, performance, expense ratio, holding, and risk details. Only Investor Class shares are made available to investors directly. Advisor, A, C, I, and Y Classes of shares are only available for purchase by institutions. Growth stocks can perform differently from the market as a whole and can be more volatile than other types of stocks. Stock markets are volatile and can decline. c) foreign securities. John Hancock does not provide This sub-account previously invested in a different share class of the same underlying portfolio. Share Class Inception Date. 05/01/ Fund Net Assets1 as of 06/30/ Alphabet Inc Class C. %. GE Aerospace. %. Netflix Inc. %. Portfolio. C shares of other American Funds for dollar cost averaging purposes. Exchange purchases are subject to the minimum investment requirements of the fund. Find the latest performance data chart, historical data and news for The Growth Fund of America Class C Shares (GFACX) at trading-btc.site

10 Year House Loan

Facts & Figures · Loan terms between 10 and 30 years. · Down payments as low as 3% of purchase price. · Single family loan amounts up to $, · Available. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. A year mortgage is a home loan that lets you repay your lender over just 10 years. It could be a good option for you if you're looking to refinance. Home equity: 10%; Cash out: $0. The following assumptions This offer effectively reduces the rate of the loan by 1% for the first year of the mortgage. 10 Year · 30 Year · All Treasuries. Close submenuCharts. MBS vs 30 YR Fixed · 10YR Mortgage Loan Comparison · Early Payoff. WIDGETS. Mortgage Rates Widgets. Always know exactly how much principal and interest you'll pay, no matter how interest rates change. Plus, prepay up to 10% of your original mortgage amount. To qualify for a year mortgage, you'll need to prove you can afford the payments. For a conventional mortgage, you'll also need at least a 3% down payment, 2. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Facts & Figures · Loan terms between 10 and 30 years. · Down payments as low as 3% of purchase price. · Single family loan amounts up to $, · Available. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. A year mortgage is a home loan that lets you repay your lender over just 10 years. It could be a good option for you if you're looking to refinance. Home equity: 10%; Cash out: $0. The following assumptions This offer effectively reduces the rate of the loan by 1% for the first year of the mortgage. 10 Year · 30 Year · All Treasuries. Close submenuCharts. MBS vs 30 YR Fixed · 10YR Mortgage Loan Comparison · Early Payoff. WIDGETS. Mortgage Rates Widgets. Always know exactly how much principal and interest you'll pay, no matter how interest rates change. Plus, prepay up to 10% of your original mortgage amount. To qualify for a year mortgage, you'll need to prove you can afford the payments. For a conventional mortgage, you'll also need at least a 3% down payment, 2. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet.

The year fixed mortgage rate on September 10, is down 11 basis points from the previous week's average rate of %. Additionally, the current national. Lending limitations such as property state and loan amount may apply. Year Fixed Rate. Rate: %. 10 · Chase logo links to Chase Home · ATM & branch · Sign in; Show Search LOAN TYPE. 15 year Fixed. RATE. XXX. APR Footnote(Opens Overlay). XXX. LOAN TYPE. The year fixed-rate refinance loan option gives you an aggressive way to pay off your home quickly, with higher monthly payments but major interest savings. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. The big differences between an interest-only mortgage and, say, a year ARM are usually the underwriting restrictions and loan amount. Interest-only loan. Mortgage rate options ; 5-year variable rate, %, % ; 5-year variable rate *( days locked rate), %, % ; 7-year fixed rate, %, % ; year. In addition to the popular year fixed-rate first mortgage, Star One offers a year mortgage, year mortgage and year mortgage. Today's mortgage rates. Canadian historical mortgage rates for prime rates, variable rates and fixed terms. Ten year rate history report for mortgages of several mortgage terms. The best 3-year fixed insured mortgage rate is %, which is 10 bps lower than 30 days ago and 0 bps higher than 7 days ago; The best 4-year fixed insured. Average year mortgage rates tend to be between 3% and 4%, but they vary. Here are some of the best year mortgage rates and providers to help you decide. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. 6% % APR. 5-year closed-term fixed-rate residential mortgage, %§. Explore year fixed-term residential, %◊. Explore fixed-term fixed-rate Book an. Evaluate Canada's best mortgage rates in one place. RATESDOTCA's Rate Matrix lets you compare pricing for all key mortgage types and terms. ; year fixed rate. year fixed home equity loan · % · %. Check out our top loans. Home Before you start house hunting, determine how much home you can afford by. The Annual Percentage Rate (APR) for the posted rates above open fixed-rate mortgages are: 6 month %, 1 year % and 2 years %. Closed variable-rate. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. A year mortgage is the shortest fixed-rate loan available for a home purchase. As with longer-term mortgage loans, the monthly payment remains the same. Whether your budget allows for a shorter-term loan: Use the calculator to compare the monthly payments and total interest between a , , or year.

Commercial Insurance Medical

Our small business portfolio includes a variety of PPO, HMO, POS and high deductible health plans along with a wide choice of networks. Virginia Commercial Health Plans · All Savers® · Mid-Atlantic Health Plan · UnitedHealthcare® Core and Core Essential · UnitedHealthcare Navigate® · UnitedHealthcare. Commercial health insurance, also referred to as private insurance, is the most common form of health insurance in the United States, covering nearly two. Consumer resources on a variety of health insurance topics, including a list of individual health plans and a glossary of health insurance terms. Pennsylvania's health insurance market can be broken down into commercial fully insured/self-insured, Medicaid and Medicare and CHIP. There are different. Filings may contain or incorporate material that is protected by U.S. or foreign copyright laws, and no person may reproduce, redistribute, or make commercial. Commercial health insurance plans cover many preventive services at no cost to the patient. These services may include routine immunizations, screenings, annual. Insureon has helped small businesses secure over million policies. We also cover healthcare facilities and therapy and counseling professionals. Offering health benefits is a major decision for businesses. Use trading-btc.site as a resource to learn more about health insurance products and services for. Our small business portfolio includes a variety of PPO, HMO, POS and high deductible health plans along with a wide choice of networks. Virginia Commercial Health Plans · All Savers® · Mid-Atlantic Health Plan · UnitedHealthcare® Core and Core Essential · UnitedHealthcare Navigate® · UnitedHealthcare. Commercial health insurance, also referred to as private insurance, is the most common form of health insurance in the United States, covering nearly two. Consumer resources on a variety of health insurance topics, including a list of individual health plans and a glossary of health insurance terms. Pennsylvania's health insurance market can be broken down into commercial fully insured/self-insured, Medicaid and Medicare and CHIP. There are different. Filings may contain or incorporate material that is protected by U.S. or foreign copyright laws, and no person may reproduce, redistribute, or make commercial. Commercial health insurance plans cover many preventive services at no cost to the patient. These services may include routine immunizations, screenings, annual. Insureon has helped small businesses secure over million policies. We also cover healthcare facilities and therapy and counseling professionals. Offering health benefits is a major decision for businesses. Use trading-btc.site as a resource to learn more about health insurance products and services for.

It is possible for Medicaid beneficiaries to have one or more additional sources of coverage for health care services. Third Party Liability (TPL) refers to. Just over half of the total U.S. population receives health insurance through commercial plans that are offered by employers or purchased by individuals. Cigna Healthcare offers health insurance plans such as medical and dental to individuals and employers, international health insurance, and Medicare. Professional liability insurance coverage protects the business if a medical professional makes a mistake when providing services. General Liability Choice. Spoilage coverage can help pay to replace perishable medicines that are lost as a result of a power outage, equipment breakdown or fridge contamination issue. The Small Business Health Options Program (SHOP) is the name of the small group health insurance exchange that the federal government established in South. Call your insurance company for more information. Commercial insurance plan. Commercial health insurance is typically an employer-sponsored or privately. Power Pac and Medical Dental Premier · Get specialized coverage for your specialized business. · includes · Water/sewer backup · covers damage to diagnostic. The rules and regulations that apply to the various forms of commercial health plans can differ depending on the nature and structure of the plan, where it is. Property insurance can protect your business in case of a loss, and liability coverage may be needed in case of a lawsuit. Some employers also purchase key. Explore health insurance options including Medicare, Medicaid, individual and family, short term and dental, as well as employer plans. Applying for health insurance is easier than ever, and small businesses have many options. NY State of Health Small Business Marketplace: If you have or. Chubb's deep healthcare insurance and risk management expertise lets you focus on the business of care. · Medical liability insurance · Package insurance for. FAIR Health's mission is to help you understand your healthcare costs and health coverage and to bring transparency to healthcare costs and insurance. You can buy private insurance, called a Qualified Health Plan, on the NY State of Health Marketplace. You can get help to apply from someone in your community. Aetna offers health insurance, as well as dental, vision and other plans, to meet the needs of individuals and families, employers, health care providers. The majority of our health coverage topics are based on analysis of the Census Bureau's American Community Survey (ACS) by KFF. All of the full-time faculty physicians of Washington University School of Medicine participate in the health insurance plans listed below. Do You Need a Quality, Affordable Health Insurance Solution for Your Employees? Fidelis Care has specialized insurance solutions for small business owners. List of Insurers Providing Health Insurance Coverage ; Guardian Life Insurance Company of America, , trading-btc.site ; Health Net Life Insurance.

Best Way To Transfer Money Abroad

Instead, find an online specialist currency transfer firm – these almost always have better rates, making your transfer much cheaper. This guide has full info. Send money overseas safely with US Postal Service international money orders. You may send money to people or businesses in countries that have agreements with. Western Union. Western Union is the best bet if your family member or friend needs to receive money via cash. · MoneyGram. MoneyGram is the second-largest money. Sending money abroad: a guide · You may need to make overseas money transfers for a variety of reasons. This service could be particularly useful for people. Wire transfer services are great for wiring smaller amounts of money internationally. Take Boss Revolution for example. This international money transfer. What is the best way to transfer money abroad? The traditional ways to send money internationally — banks and wire transfers — are increasingly being. Choose to send money internationally or locally, directly to your recipient's bank account, a nearby Western Union location or to their mobile wallet. What are the best ways to send money internationally? · Bank transfer: Sending money from your current account might be slower than a debit or credit card. 1. Bank-to-Bank Transfers Some banks let you take money directly from your bank account and deliver it to a recipient's bank account. Instead, find an online specialist currency transfer firm – these almost always have better rates, making your transfer much cheaper. This guide has full info. Send money overseas safely with US Postal Service international money orders. You may send money to people or businesses in countries that have agreements with. Western Union. Western Union is the best bet if your family member or friend needs to receive money via cash. · MoneyGram. MoneyGram is the second-largest money. Sending money abroad: a guide · You may need to make overseas money transfers for a variety of reasons. This service could be particularly useful for people. Wire transfer services are great for wiring smaller amounts of money internationally. Take Boss Revolution for example. This international money transfer. What is the best way to transfer money abroad? The traditional ways to send money internationally — banks and wire transfers — are increasingly being. Choose to send money internationally or locally, directly to your recipient's bank account, a nearby Western Union location or to their mobile wallet. What are the best ways to send money internationally? · Bank transfer: Sending money from your current account might be slower than a debit or credit card. 1. Bank-to-Bank Transfers Some banks let you take money directly from your bank account and deliver it to a recipient's bank account.

Wire transfers are a quick way to send money domestically or internationally. While you can do both in Mobile Banking and Online Banking, this guided demo. These entities are focused on helping you send money overseas safely, cheaply, and quickly using the speed and accessibility of the Internet. To get started is. The best way to make a transfer for up to €20, is using online on your desktop or the mobile app. It's easy and done in a few simple clicks. There. You need the recipient's name, address and bank information, including SWIFT code and account number. · You can send in U.S. dollars or foreign currency; cutoff. 1. Choose the option that's best for you. Bank draft, wire transfer, money order or online remittance – for the occasional transfer, you might not be fussy. The best ways to send money abroad with Revolut · Bank transfer · Card transfer · Mobile wallet transfer · Revolut-to-Revolut transfer · Payment link transfer · Group. Most people want to send or receive money to and from checking accounts. You can do this by connecting your bank account to a third-party transfer service like. Convenience often plays a crucial role in these cases. Work with your recipient to figure out the best way to receive money where they are located. How to transfer money internationally? · Create an account This is simple. · We'll verify your details For even better security, we'll verify who you are. · Start. When you wire money, you are sending cash to someone far away. This is also called a money transfer. Many people wire money to family or friends in other. Find the best ways to transfer money internationally · Online money transfer services · Banks · Third-party payment services · Cash pick-up · International or. TransferWise is one of the cheapest online money transfer services to send money anywhere in the world. Those seeking to send money from the. Wire Transfers: This is one of the common methods of sending money internationally. · Bank drafts: Another safest and most popular way to send money overseas is. Send Money Internationally from the United States with the MoneyGram® Money Transfers App. With millions of downloads, the MoneyGram mobile app is an easier way. Traditional methods of sending money—such as through your bank—are still applicable today. · Overseas transfers through your bank are possible, but there are. How do I transfer money internationally? · Enter your recipient's name, PayPal handle, email, or mobile phone. · Enter the amount, choose the currency, and add a. Find the cheapest ways to transfer money internationally · Bank transfer. We charge a small fee for international bank transfers, depending on the currency and. Bank transfer to the United States – most banks will let you send money internationally online, by visiting a branch or by phone. Payments to USD will be sent. Traditional methods of sending money—such as through your bank—are still applicable today. · Overseas transfers through your bank are possible, but there are. You came to the right place. The Consumer Financial Protection Bureau is a U.S. government agency dedicated to making sure you are treated fairly by banks.

How Much To Spend On First Home

Buying Your New Home: Savings and Expectations. Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account. Most types of home loans require a minimum down payment of % of the purchase price on a home (however, on FHA and Conventional mortgage loans, anything less. When budgeting for a house, consider only spending up to 28% of your monthly income on your mortgage payment. Author. By Josh Patoka. Josh Patoka. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. Compare your after-tax income with your estimated ownership costs, as well as general household expenses such as groceries, bills, transport, schooling and. If you spend 20% or less of your gross income on housing, and save 20% of your net income towards investments and retirement accounts, you'll be well on your. Start With a Personal Budget The first step to budgeting for your first home is to consider your monthly expenses. If you have outstanding debt, such as. Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you. Determine How Much You Can Afford to Spend on a Home To roughly estimate an affordable price range for a home, multiply your annual gross income (what you. Buying Your New Home: Savings and Expectations. Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account. Most types of home loans require a minimum down payment of % of the purchase price on a home (however, on FHA and Conventional mortgage loans, anything less. When budgeting for a house, consider only spending up to 28% of your monthly income on your mortgage payment. Author. By Josh Patoka. Josh Patoka. TDS looks at the gross annual income needed for all debt payments like your house, credit cards, personal loans and car loan. Depending on the lender, TDS. Compare your after-tax income with your estimated ownership costs, as well as general household expenses such as groceries, bills, transport, schooling and. If you spend 20% or less of your gross income on housing, and save 20% of your net income towards investments and retirement accounts, you'll be well on your. Start With a Personal Budget The first step to budgeting for your first home is to consider your monthly expenses. If you have outstanding debt, such as. Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you. Determine How Much You Can Afford to Spend on a Home To roughly estimate an affordable price range for a home, multiply your annual gross income (what you.

For most, a % deposit is standard, with 20% of the property value being ideal. Some government schemes for first time buyers, and some mortgages, will. According to recent data from the National Association of Realtors (NAR), the range for first-time buyers is between 6 to 7%, depending on the housing market in. Down Payment: With an FHA loan, you can put as little as 3 percent down to purchase a home (plus closing costs—although the seller may be able to assist with. If this is your first time buying a home, make sure you factor in those closing costs when you're starting to crunch the numbers. They'll usually be around %. The first step to budgeting for your first home is to consider your monthly expenses. If you have outstanding debt, such as credit card bills, personal loans. “Other rules say you should aim to spend less than 28% of your pre-tax monthly income on a mortgage,” says Hill. Known as the "28/36 rule," this can be a solid. Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments, plus additional. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Remember to account for all fees associated with buying a house. Here are a few expenses to add to your budget, along with that mortgage payment due the first. You may qualify for loan programs that require from as little as 2 percent for a down payment to as much as 20 percent, based on the purchase price of the home. If you're looking to buy your first home, you'll need to have room in your budget for a mortgage and related housing costs. Navy Federal Credit Union spells. How We Calculate Your Home Value. First, we calculate how much money you can borrow based on your income and monthly debt payments; Based on the recommended. For FHA loans, a down payment of % is required for maximum financing. So for the same $, home, you would need to come up with at least $17, This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. How much deposit do I need to buy a home? Before looking at properties, you need to save for a deposit. Generally, you need to try to save at least 5% of the. First, calculate your total available savings and investments. · Next, estimate costs to "close.” Typically closing costs range from 2% to 5% of the home. But I wouldn't spend much more than 3X your household income on a home if your mortgage rate is over 6%. Home-Buying Examples Using My 30/30/3 Rule. To help. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Putting 20% down on a home is ideal, but first time home buyers can use these tips to make a smart home purchase without a large down payment. On average, buyers should shoot for a mortgage payment that is percent of their monthly take-home income. Mortgage payments that are higher than that can.

1 2 3 4 5 6